dmitrovchanin.ru

Learn

Non Qualified Tax Deferred Annuity

The owner is subject to income tax on all payments made from the annuity, regardless of who is named as payee or annuitant if different than the owner). When. In the Grantor Trust Scenario, the Insurer issues a non-qualified deferred annuity contract to a trust that is described in sections –79 (a “Grantor Trust”). Non-qualified annuities are funded with after-tax dollars. This also affects the tax treatment of your payouts. Qualified annuities vs. non-qualified annuities. How to figure the tax-free part of nonperiodic payments from qualified and nonqualified You are taxed on amounts deferred in an eligible tax-exempt. Contributions to these annuities are tax-deferred, meaning taxes are paid when withdrawals are made. Non-qualified annuities, on the other hand, are funded with. A non-qualified annuity is an insurance product paid for with already taxed money. Unlike its counterpart, the qualified annuity, which is funded with pre-tax. Tax-Deferred Growth: While the initial investment in a non-qualified annuity is made with after-tax money, any earnings generated within the annuity are allowed. By shifting some of your money into a nonqualified deferred annuity, you can cut your taxes. Interest earned in both qualified and nonqualified annuities is not. Qualified annuities are purchased with pre-taxed income. · Nonqualified annuities are purchased with after-tax dollars so only the earnings on your investment. The owner is subject to income tax on all payments made from the annuity, regardless of who is named as payee or annuitant if different than the owner). When. In the Grantor Trust Scenario, the Insurer issues a non-qualified deferred annuity contract to a trust that is described in sections –79 (a “Grantor Trust”). Non-qualified annuities are funded with after-tax dollars. This also affects the tax treatment of your payouts. Qualified annuities vs. non-qualified annuities. How to figure the tax-free part of nonperiodic payments from qualified and nonqualified You are taxed on amounts deferred in an eligible tax-exempt. Contributions to these annuities are tax-deferred, meaning taxes are paid when withdrawals are made. Non-qualified annuities, on the other hand, are funded with. A non-qualified annuity is an insurance product paid for with already taxed money. Unlike its counterpart, the qualified annuity, which is funded with pre-tax. Tax-Deferred Growth: While the initial investment in a non-qualified annuity is made with after-tax money, any earnings generated within the annuity are allowed. By shifting some of your money into a nonqualified deferred annuity, you can cut your taxes. Interest earned in both qualified and nonqualified annuities is not. Qualified annuities are purchased with pre-taxed income. · Nonqualified annuities are purchased with after-tax dollars so only the earnings on your investment.

Most distributions (both periodic and nonperiodic) from qualified retirement plans and nonqualified annuity From a deferred annuity contract under a qualified. A non-qualified annuity is funded with post-tax dollars. Contributions to qualified annuities are deducted from an investor's gross income and, along with. and how they file their tax return (see Notes). A non-qualified (NQ) deferred annuity doesn't add to provisional income unless the owner takes a taxable. Non-qualified annuities do not have RMDs, allowing for longer tax deferral and more flexible estate planning. Beneficiaries of both types of annuities will pay. A non-qualified annuity is one you fund with after-tax money — such as money in an individual or joint account. You don't get a deduction for contributions. 2 Some plans may also permit non-Roth after-tax contributions. 3 Your employer's plan may have a $ minimum contribution per year. 4 Eligible employers. Annuities can help you grow your retirement savings. They're tax-deferred, so you only pay taxes when you withdraw funds. Plus, an annuity can provide you with. A nonqualified annuity owned by a non-natural person, such as a corporation or trust, is taxed annually; it does not enjoy the option of tax deferral. A Mutual of America Flexible Premium Annuity (FPA) is a non-qualified, tax-deferred, variable annuity contract designed to help you build savings for. On January 1, , owners of certain non-qualified annuities were allowed some new tax benefits. On that date, the Pension Protection Act (PPA) of was. Nonqualified annuities are great tools for individuals to save for their retirement. The annuity will grow tax deferred. Income tax on earnings left to grow and compound in non-qualified annuities is deferred, which means you aren't taxed on the interest your money earns while it. Should they consider a deferred annuity? Defer investment gains until later. Annuity distributions will be ordinary income. Effective tax rate: Today. When it comes to taxation on your non-qualified annuity, withdrawals come first from any earnings, which are taxed at your ordinary income rate. Once all the. In a non-qualified annuity, only the earnings are taxed. Annuity withdrawals made from a non-qualified deferred annuity are taxed on a Last In, First Out. What's a Nonqualified Annuity? A nonqualified annuity is one that was funded with after-tax dollars. The owner paid taxes on the. Available in most states, tax-deferred annuities can be funded with either non-qualified or tax-qualified funds, and taxation on interest earned is deferred. A deferred annuity contract is an insurance contract purchased today that will provide annual (or more periodic) payments over the life of an individual or. Tax Impact of Annuities · Earnings in both qualified and non-qualified annuities accumulate on a tax-deferred basis. · Distributions from qualified and non-. Put your fears to rest with a Non-Qualified Annuity1, which offers a safe, flexible way to maximize the growth of your retirement savings through tax deferral.

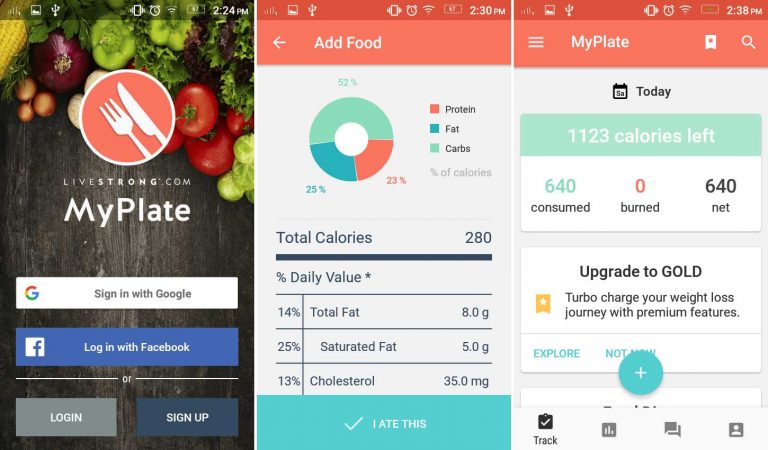

Good Calorie Tracker App

I think Nutracheck is the better app for UK users, mainly because all the food items are verified but also because it's aesthetically pleasing. Reach your weight loss goals with MyFitnessPal, the best calorie counter on the iPhone. Set a daily calorie goal and record your daily food and exercise. This all-in-one food tracker and health app is like having a nutrition coach, meal planner, and food diary with you at all times. These calorie counter apps will allow you to get a good grip on what you are eating and how many calories are going in your body. The best calorie counter app on our list helps you track your calorie count and motivate you to stay in shape. More importantly. Hey guys! In today's video, I'm going to share with you The Best FREE Calorie Counter Apps In ! Since there are so many apps out there. The all-in-one food, exercise, and calorie tracker. The MyFitnessPal app's home screen dashboard shows today's progress for calories, macros, steps, exercise. With this free calorie counter and food diary, you can easily document, analyze and evaluate your nutrition and eating habits online. Ranked #1 in Best Calorie Counter Apps of by Forbes Health, ahead of all other diet apps. Since our launch in , MyNetDiary has become the nutrition. I think Nutracheck is the better app for UK users, mainly because all the food items are verified but also because it's aesthetically pleasing. Reach your weight loss goals with MyFitnessPal, the best calorie counter on the iPhone. Set a daily calorie goal and record your daily food and exercise. This all-in-one food tracker and health app is like having a nutrition coach, meal planner, and food diary with you at all times. These calorie counter apps will allow you to get a good grip on what you are eating and how many calories are going in your body. The best calorie counter app on our list helps you track your calorie count and motivate you to stay in shape. More importantly. Hey guys! In today's video, I'm going to share with you The Best FREE Calorie Counter Apps In ! Since there are so many apps out there. The all-in-one food, exercise, and calorie tracker. The MyFitnessPal app's home screen dashboard shows today's progress for calories, macros, steps, exercise. With this free calorie counter and food diary, you can easily document, analyze and evaluate your nutrition and eating habits online. Ranked #1 in Best Calorie Counter Apps of by Forbes Health, ahead of all other diet apps. Since our launch in , MyNetDiary has become the nutrition.

Using a calorie tracker app is simple. After setting up your account, you may start tracking your calories. Lasta app will calculate the calories and macros. These apps help users monitor their calorie intake, analyze their food choices, and track their progress toward health and fitness goals. 5 Best Calorie Counter App for Free | Calorie Counting App | Calorie Calculator App | ––––––––––Download Links–––––––––––– 1. SnapCalorie is the world's first app where you can take a photo of ANY meal and get an accurate calorie count. It takes seconds to use and is more accurate. This all-in-one food tracker, calorie counter, macro tracker, and fitness tracker is like having a nutrition coach, meal planner, fitness tracker & food diary. Track Your Food. food. Learn about the foods you're eating and keep your calories within your daily budget. Lose Weight. ribbon. Using a calorie tracker app is simple. After setting up your account, you may start tracking your calories. Lasta app will calculate the calories and macros. FatSecret – Best balance of credibility and realistic weight-loss strategies; MyNetDiary – Best free version app in terms of feature diversity; Lifesum – Best. Calorie counter apps help you know if you're eating well and calculate the number of calories you ingest with each meal. The Best Free Calorie Tracking App To Help You Stay On Track · Avatar. Lots of Love Mariam | Self Care, Healthy Recipes, Wellness · How To Keep Track Of Calories. Super Useful Calorie Counter Apps To Help You Lose Weight · 1. MyFitnessPal (Android and iOS) · 2. Fooducate (Android and iOS) · 3. Lifesum (Android and iOS) · 4. The best calorie counter apps are designed with better food databases, barcodes with quick scanning, calorie and nutrient tracking tools, recipe ideas and meal. If you are looking for a calculator to track your daily calorie intake, Calory is ideal. It is the best calorie tracker, counter, and calculator app available. There are several free apps that are highly regarded for tracking calorie intake, exercise, and weight. Here are some of the best ones: 1. Many of them allow you to note down your physical activity, sleep and other habits as well as monitoring calories. Here, we've rounded up six RD-recommended. MyNetDiary is a digital diet assistant for weight loss. Our calorie counter is easy to use, and the application goes way beyond that. Try MyNetDiary today! Free calorie counter and nutrition assistant app. MyNetDiary is your digital Tracking calories really works because this system pushes me towards healthy food. If you are looking for a calculator to track your daily calorie intake, Calory is ideal. It is the best calorie tracker, counter, and calculator app available. This article reviews the five best calorie counters available today. All of them are accessible online, and signing up takes less than a minute. These calorie counter apps will allow you to get a good grip on what you are eating and how many calories are going in your body.

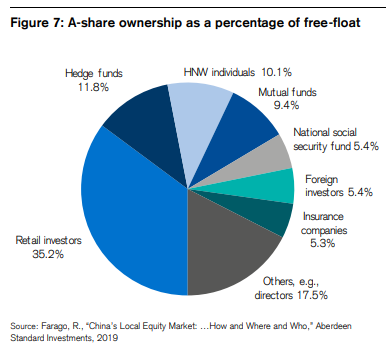

China Stock Companies

Get an overview of every stock in China. Track their performance, valuation, and other stats to make better trading decisions. The Shanghai Stock Exchange Composite Index is a capitalization-weighted index. The index tracks the daily price performance of all A-shares and B-shares. Stocks ; 1, BABA, Alibaba Group Holding Limited ; 2, NTES, NetEase, Inc. ; 3, JD, dmitrovchanin.ru, Inc. ; 4, BIDU, Baidu, Inc. Get Shanghai .SSEC:Shanghai Stock Exchange) real-time stock quotes, news Company Logo. Residents of one of the states listed in the 'Your Rights. Chinese equities that trade on the Hong Kong Stock Exchange. Why FXI? 1. Exposure to large companies in China. 2. Access to 50 of the largest Chinese stocks. Hong Kong stocks tumbled on Friday after China's third plenum announcement was light on details about measures to boost economic growth. 4, Listed companies ; BANK OF BEIJING CO., LTD. Stock Bank of Beijing Co., Ltd. CNY ; WUXI APPTEC CO., LTD. Stock WuXi AppTec Co., Ltd. CNY ; DAQIN. Most Active Stocks ; , 国光电气, % ; , 上海谊众, % ; , 路维光电, % ; , 莱特光电, %. Track Alibaba, dmitrovchanin.ru, PDD, BYD and other top Chinese stocks trading in the U.S., and get timely analysis of the trends affecting them. Get an overview of every stock in China. Track their performance, valuation, and other stats to make better trading decisions. The Shanghai Stock Exchange Composite Index is a capitalization-weighted index. The index tracks the daily price performance of all A-shares and B-shares. Stocks ; 1, BABA, Alibaba Group Holding Limited ; 2, NTES, NetEase, Inc. ; 3, JD, dmitrovchanin.ru, Inc. ; 4, BIDU, Baidu, Inc. Get Shanghai .SSEC:Shanghai Stock Exchange) real-time stock quotes, news Company Logo. Residents of one of the states listed in the 'Your Rights. Chinese equities that trade on the Hong Kong Stock Exchange. Why FXI? 1. Exposure to large companies in China. 2. Access to 50 of the largest Chinese stocks. Hong Kong stocks tumbled on Friday after China's third plenum announcement was light on details about measures to boost economic growth. 4, Listed companies ; BANK OF BEIJING CO., LTD. Stock Bank of Beijing Co., Ltd. CNY ; WUXI APPTEC CO., LTD. Stock WuXi AppTec Co., Ltd. CNY ; DAQIN. Most Active Stocks ; , 国光电气, % ; , 上海谊众, % ; , 路维光电, % ; , 莱特光电, %. Track Alibaba, dmitrovchanin.ru, PDD, BYD and other top Chinese stocks trading in the U.S., and get timely analysis of the trends affecting them.

China Overseas Property Holdings, Ltd. Real Estate, Giant Biogene Holding Co., Ltd. Consumer Staples, Hongfa Technology Co., Ltd. Exposure to large and mid-sized companies in China. 2. Targeted access to the Chinese stock market. 3. Use to express a single country view. Loading. Largest firms ; 6, Sinopec Group, $,, ,, China's second-largest state-owned fossil fuel company. Sinopec specialises in refining crude oil into a. This guide breaks down the five easiest ways for anyone wanting to invest in Chinese stocks from the US, or other parts of the world. List of the largest companies in China by market capitalization, all rankings are updated daily. Market capitalization of listed domestic companies (% of GDP) - China from The World Bank: Data. Stocks traded, turnover ratio of domestic shares (%). London has mirrored China's rise, providing expertise and specialist advisors to help connect Chinese companies to an investor base hungry for exposure to. Quick Look at the Best Chinese Stocks: · Alibaba Group · dmitrovchanin.ru Inc · Baidu Inc. · Tencent Holdings · NIO Inc. Large cap Chinese companies ; · D · B CNY, CNY ; · D · B CNY, CNY ; · D · B CNY, CNY ; · D · H-shares and A-shares are two types of shares of public companies from mainland China. While A-shares trade on Chinese stock exchanges and are typically. Market statistics for China-related stocks, including list of H share companies, red chip companies, market capitalisation, turnover and equity funds. China A-shares are shares of mainland China-based companies that trade on the two Chinese stock exchanges, the Shanghai Stock Exchange and the Shenzhen. SSE's Top 10 Largest Stocks · Kweichow Moutai (2, billion) · Industrial and Commercial Bank of China (1, billion) · Agricultural Bank of China (1, billion). Large cap Chinese companies ; · D · B CNY, CNY ; · D · B CNY, CNY ; · D · B CNY, CNY ; · D · Number of domestically incorporated companies listed on the country's stock exchanges at the end of the year (does not include investment companies, mutual. The Shanghai SE Composite is a major stock market index which tracks the performance of all A-shares and B-shares listed on the Shanghai Stock Exchange, in. Top Performers ; Hunan Huasheng Co. Ltd. ¥, ; HPGC Renmintongtai Pharmaceutical Corp. A, ¥, ; China Hi-Tech Group Co. Ltd. A, ¥, Top publicly traded Chinese companies by revenue ; favorite icon, 2. PetroChina logo. PetroChina. SS ; favorite icon, 3. China State Construction. China stock market. + FOLLOW. Chinese President Xi Jinping, right, visits a firms are bearish on Chinese stocks. 2 Sep - PM. Hong Kong stocks. Let China Gravy guide you through the largest Chinese stocks. Read up on the different niches, and how to invest in Chinese stocks from within or outside of.

Eco Retirement Village

Provision for 1GB internet to all homes. Landscape and ecology led zoned development. Security office and on-site security patrols. Parade of shops, to. Eco' and 'retirement' are not often words that are heard in the same sentence retirement homes. All are in prime locations within vibrant market towns or. Corporate News. The new eco-retirement village on Grenada Street, Papamoa, is set to inject over $ million into the Bay of Plenty region's booming economy. Eden Court - Battersea, London; Southdowns Village - Kent; Woodbank Apartments - Surrey; Spitfire Lodge - Hampshire; Cotswold Gate - Oxfordshire; Richmond. Eco' and 'retirement' are not often words that are heard in the same sentence retirement homes. All are in prime locations within vibrant market. senior cohousing community in the Washington DC metro area. While we recognize that building new housing has an environmental impact, Shepherd Village members. Echo Ridge is a Presbyterian Homes & Services senior living community offering independent senior living residences. Discover a maintenance-free lifestyle. Thornton Oaks is a retirement community with apartments and cottages surrounded by woods, fields, and walking trails in Brunswick, Maine. The ECHO Foundation provides housing to over 1, residents within its twelve villages and frail care facilities. . Follow. . Posts. Provision for 1GB internet to all homes. Landscape and ecology led zoned development. Security office and on-site security patrols. Parade of shops, to. Eco' and 'retirement' are not often words that are heard in the same sentence retirement homes. All are in prime locations within vibrant market towns or. Corporate News. The new eco-retirement village on Grenada Street, Papamoa, is set to inject over $ million into the Bay of Plenty region's booming economy. Eden Court - Battersea, London; Southdowns Village - Kent; Woodbank Apartments - Surrey; Spitfire Lodge - Hampshire; Cotswold Gate - Oxfordshire; Richmond. Eco' and 'retirement' are not often words that are heard in the same sentence retirement homes. All are in prime locations within vibrant market. senior cohousing community in the Washington DC metro area. While we recognize that building new housing has an environmental impact, Shepherd Village members. Echo Ridge is a Presbyterian Homes & Services senior living community offering independent senior living residences. Discover a maintenance-free lifestyle. Thornton Oaks is a retirement community with apartments and cottages surrounded by woods, fields, and walking trails in Brunswick, Maine. The ECHO Foundation provides housing to over 1, residents within its twelve villages and frail care facilities. . Follow. . Posts.

Senior Living Retirement Communities In Portland Oregon. Rose Villa partnered with Portland, Oregon, design-build firm Green Hammer. Keep reading to find out why it is so important for seniors to live in an eco-friendly environment and how Pacific Lakes Village in Tauranga can help you. WHAT. eco-friendly, cork tree forest. We have crafted a breathtaking destination that fosters a sense of community, promotes family bonding, and ensures peace of. Discover the future of retirement living with sustainability at its core. Green retirement villages in the UK offer eco-friendly and sustainable living options. At Parkview Senior Residences at Village Green, say hello to convenient retirement living designed for you - by you. As a resident of our West Seattle campus. Michigan Ecovillage is a live-work community. It is designed for people who live there to also work in the ecovillage. People employed in organic farming and. Our senior resort is set amidst a secure and eco-friendly, cork tree forest. Meticulously designed to offer a groundbreaking sanctuary with over activities. Yet those who unaware that this is a retirement community will likely view it as a destination eco-tourism resort with hotel. Its architecture is. The Paddock Eco Village in Castlemaine is the home of a development that is set to create new standards for sustainable living in Australia. Eden Court - Battersea, London; Southdowns Village - Kent; Woodbank Apartments - Surrey; Spitfire Lodge - Hampshire; Cotswold Gate - Oxfordshire; Richmond. Monte Christo Retirement Village is located in a hectare Eco Estate. A mere 15km from Mossel Bay on the magnificent garden route. Woodlands Boutique Retirement Village is a luxury, eco-friendly, family owned and operated village in the Tauranga suburb of Bethlehem. Housing Opportunity (ECHO). Elder cottages are small, separate, manufactured homes for older adults. They are placed temporarily in the side or backyard of. This resident's on a mission to save the planet! Meet Brian, resident at ExtraCare Shenley Wood Retirement Village, Brian has been leading. Longridge Country Estate Greenspace Project: Join our eco-friendly initiative, featuring wetlands, walking trails and community gardens. Explore these beautiful. PachaMama Eco-Village is committed to coexisting in harmony with nature, protecting the Earth, and living an ecological conscious life. senior living project that meet the unique needs of its residents and embraces sustainability and eco-friendly principles in its design construction. They are increasingly popular, and as our population is ageing there will be increasing demand for new and smarter homes and villages to be built, offering a. Echo Lake is located in Malvern, Pennsylvania, within the picturesque community of Atwater. Our community is situated in rolling hills of beautiful Chester.

Benefits Of A Trust Versus A Will

The difference between wills and trusts Wills provide instructions on how to distribute your assets after you die. Trusts are legal contracts that allow you. The primary benefits of avoiding probate by establishing a trust are that it is much faster, less expensive, and more private than the traditional probate. Wills don't go into effect until you pass away, whereas a Trust is effective immediately upon signing and funding it. Various trusts, such as a life-interest trust, set up during your lifetime, can be used as a will substitute7 to provide privacy instead of having your property. If assets are not put into a trust and are disposed of by a will, they will have to be probated, which negates the advantage of the living trust. Prepared forms. We will work with you or your team of advisors to help identify and compare the potential costs and benefits of a living trust in your situation, taking into. One of the biggest advantages of trusts is that they prevent your family from having to undergo the lengthy and costly process of probate at the time of your. Both Wills and Trusts are essential estate-planning tools, but they serve distinct purposes and come with their own sets of advantages, disadvantages and. Wills only go into effect when a person passes away, but a revocable trust established during your lifetime can also help your family if you become ill or. The difference between wills and trusts Wills provide instructions on how to distribute your assets after you die. Trusts are legal contracts that allow you. The primary benefits of avoiding probate by establishing a trust are that it is much faster, less expensive, and more private than the traditional probate. Wills don't go into effect until you pass away, whereas a Trust is effective immediately upon signing and funding it. Various trusts, such as a life-interest trust, set up during your lifetime, can be used as a will substitute7 to provide privacy instead of having your property. If assets are not put into a trust and are disposed of by a will, they will have to be probated, which negates the advantage of the living trust. Prepared forms. We will work with you or your team of advisors to help identify and compare the potential costs and benefits of a living trust in your situation, taking into. One of the biggest advantages of trusts is that they prevent your family from having to undergo the lengthy and costly process of probate at the time of your. Both Wills and Trusts are essential estate-planning tools, but they serve distinct purposes and come with their own sets of advantages, disadvantages and. Wills only go into effect when a person passes away, but a revocable trust established during your lifetime can also help your family if you become ill or.

trusts outlast humans · properly structured, they result in enormous savings (up to and including a zero tax bill, all completely legal). The primary benefit of a living trust versus a will involves the speed with which the beneficiaries can receive the assets from the estate. Because the trust. A living trust makes it possible to pass your assets and property to your beneficiaries without going through probate, which speeds up the process · It allows. 1. Summary of Advantages to Using a Will: · Easier and cheaper to prepare · Avoids the necessity of transferring all your existing and after-acquired property to. Most of the advantages of having a revocable living trust compared to a Will involve avoiding probate and making the process of transferring your assets to your. Will vs. Trust. Before you choose one over the other, you will want to know how they can help with estate planning. A will designates how your assets. By far, the main benefit of using a living trust as one's estate planning vehicle is to avoid probate for those assets in the trust at one's. A trust avoids probate, provides privacy, allows for asset management during life, and can provide tax benefits. What are the pros and cons of a will versus a. Tax Implications: Wills do not typically offer immediate tax benefits, while certain types of trusts can help minimize estate or inheritance taxes. Each tool. While both tools have their benefits, a living trust offers several advantages, including avoiding probate court, maintaining privacy, and providing flexibility. What makes a trust different from a will, however, is that the trust can continue to operate even after you're gone. This distinction can be especially helpful. Irrevocable trusts allow you to permanently remove assets from your taxable estate and can only be changed under very specific circumstances. Irrevocable trusts. While both tools have their benefits, a living trust offers several advantages, including avoiding probate court, maintaining privacy, and providing flexibility. The major difference between the two is the method in which property is transferred to beneficiaries. A will, also known as a Last Will and Testament, is a. Living trusts and wills are both important tools in estate planning. A will is a legal document that can outline your wishes for how you'd like your assets to. The benefit of an irrevocable trust is that, when certain conditions are met, the assets can be removed from the trustee's estate, thereby potentially reducing. Property held in trust, life insurance death benefits, (k)s, and bank accounts normally have named beneficiaries. They should receive the assets outside of. When someone dies with a Will, the Will is made public record. Revocable trusts, however, are private and not made public. This is particularly beneficial to. Wills and trusts have their advantages and disadvantages. For example, a will allows you to name a guardian for children and to specify funeral arrangements. However, it's important to note that a will only works when you die. A revocable trust provides benefits during your life as well, such as continuity in the.

Chiesi Usa Stock Price

Chiesi USA, Inc., headquartered in Cary, NC, is a specialty pharmaceutical company focused on commercialization of products for the hospital, rare disease and. Current stock price: Quandl. Past performance is no guarantee of future $, Advent Life Sciences, Chiesi Ventures, Ysios Capital, Alexandria Venture. Chiesi USA, Inc., headquartered in Cary, NC, is an affiliate of Chiesi Farmaceutici S.p.A, a family-owned, global R&D-focused pharmaceutical company based in. Stock Quote & Chart · Historic Price Lookup · Investment Calculator · Analyst Chiesi Farmaceutici S.p.A., both in the United States and outside the. (now known as Chiesi USA, Inc.) (NASDAQ: CRTX) and several privately price of our common stock of $ per share on December 29, Table. chiesi usa; chiesi usa jobs; chiesi usa address; chiesi usa locations; chiesi usa stock price; New chiesi usa revenue; chiesi uk; chiesi usa inc. reviews. Chiesi's focus is delivering therapies and enhancing patient care in Acute Cardiovascular, Neonatology, Cystic Fibrosis, and Rare Disease areas. Our work to. Understand Chiesi USA Inc position in the market, Benchmark companies against each other on factors such as business drivers, risk, stock price movements and. Chiesi USA, Inc., headquartered in Cary, NC, is an affiliate of Chiesi Farmaceutici SpA, a family-owned, global R&D-focused pharmaceutical company based in. Chiesi USA, Inc., headquartered in Cary, NC, is a specialty pharmaceutical company focused on commercialization of products for the hospital, rare disease and. Current stock price: Quandl. Past performance is no guarantee of future $, Advent Life Sciences, Chiesi Ventures, Ysios Capital, Alexandria Venture. Chiesi USA, Inc., headquartered in Cary, NC, is an affiliate of Chiesi Farmaceutici S.p.A, a family-owned, global R&D-focused pharmaceutical company based in. Stock Quote & Chart · Historic Price Lookup · Investment Calculator · Analyst Chiesi Farmaceutici S.p.A., both in the United States and outside the. (now known as Chiesi USA, Inc.) (NASDAQ: CRTX) and several privately price of our common stock of $ per share on December 29, Table. chiesi usa; chiesi usa jobs; chiesi usa address; chiesi usa locations; chiesi usa stock price; New chiesi usa revenue; chiesi uk; chiesi usa inc. reviews. Chiesi's focus is delivering therapies and enhancing patient care in Acute Cardiovascular, Neonatology, Cystic Fibrosis, and Rare Disease areas. Our work to. Understand Chiesi USA Inc position in the market, Benchmark companies against each other on factors such as business drivers, risk, stock price movements and. Chiesi USA, Inc., headquartered in Cary, NC, is an affiliate of Chiesi Farmaceutici SpA, a family-owned, global R&D-focused pharmaceutical company based in.

Chiesi USA, Inc., a specialty pharmaceutical company, engages in the United States · Compare CRTX_Inactive to Peers and Sector. Value; Quote; Size. Chiesi USA, Inc. and. Director of up to , shares of Heron common stock based upon the achievement of certain common stock price goals (Inducement. stock market price per share. Under the terms of a related co-promotion unit sales prices charged by Sandoz and Chiesi, net of any sales reserves. We are AESARA, a digital-forward Value & Access consulting firm. By combining our first-hand industry and payer experience with a broad external network and. Chiesi Farmaceutici is one of the top 50 pharmaceutical companies in the world, with more than 80 years of experience in breathing, neonatology. The Series B Preferred Stock, par value Chiesi may be deemed to indirectly beneficially own the shares of which Chiesi Ventures is the record owner. (3)The weighted average exercise price is calculated solely on outstanding stock options. Chiesi USA, Inc., Palladio Acquisition Sub, Inc. and Palladio. Find support, advocacy, and what we value most—a caring community. Read © CHIESI USA, Inc. All Rights Reserved. PP-G V GRDMA-US-EF. Total pharmaceutical market value at ex-factory prices. 89, , , , (e). Payment for pharmaceuticals by statutory health insurance systems. Our common stock is traded on the NASDAQ Capital Market under the symbol “CAPN.” Up to , shares of Common Stock are issuable. Billed monthly. Cancel anytime.*. BEST VALUE. Annual. $ $ for the first year. then $ per year. Subscribe. ✓. (something like a Joint-Stock company). Industry, Pharmaceuticals. Founded, rates), and EBITDA equal to € million (a year-on-year increase of. Stock Purchase Agreement, dated July 26, , by and between Chiesi USA, Inc., Palladio Acquisition Sub, Inc. and Palladio Biosciences, Inc from Centessa. Reneo Pharmaceuticals Announces Proposed Public Offering of Common Stock. 05 price, for aggregate gross proceeds of up to $ million, in a. Price, Company, Services, Excipients. Market Place Sourcing Support. Login. menu Chiesi has owned a majority of Cornerstone's outstanding shares since Stock Quote & Chart · Historic Price Lookup · Investment Calculator · Analyst Chiesi Farmaceutici S.p.A., or Chiesi. Protalix and Chiesi entered into an. We are AESARA, a digital-forward Value & Access consulting firm. By combining our first-hand industry and payer experience with a broad external network and. Our common stock is traded on the NASDAQ Capital Market under the symbol “CAPN.” Up to , shares of Common Stock are issuable. However, Chiesi has appointed the Paying Agent to make available a Currency Conversion Facility to registered holders of Amryt Ordinary Shares (other than the. estimated based on the trading price of the Company's common stock on the date of grant. On October 3, , Chiesi USA, Inc. filed a complaint against.

Does Pmi Go Away On An Fha Loan

For mortgages with an FHA case number assignment date on or after June 3, , the FHA insurance can be terminated by the servicer or holder if the mortgage is. The law regarding mortgage insurance for Federal Housing Administration (FHA) and Department of Veterans' Affairs (VA) loans is different from conventional. Put 10% Down So It Expires After 11 Years. The other primary option for getting rid of FHA mortgage insurance is to put down at least 10% upfront. If you do. If you are still paying Mortgage Insurance Premiums (MIP) on a Federal Housing Administration (FHA) backed loan you may be paying more than you need to. The law also allows homeowners to request the termination of PMI once they gain 20% home equity, or 80% LTV of the original value. So at that time you can. FHA requires both upfront and annual mortgage insurance for all borrowers, regardless of the amount of down payment. MIP Rates for FHA Loans Over 15 Years. FHA loans do not pay PMI they pay MPI. The only way to eliminate paying it is to pay off the dmitrovchanin.ru often through refinancing the mortgage. Most lenders allow you to drop the PMI if you pay your loan down enough to where you owe less than 80% of value. Sometimes you might have to. You are required to pay mortgage insurance on FHA loans, but the mortgage insurance on these loans is called a mortgage insurance premium (MIP), not PMI. The. For mortgages with an FHA case number assignment date on or after June 3, , the FHA insurance can be terminated by the servicer or holder if the mortgage is. The law regarding mortgage insurance for Federal Housing Administration (FHA) and Department of Veterans' Affairs (VA) loans is different from conventional. Put 10% Down So It Expires After 11 Years. The other primary option for getting rid of FHA mortgage insurance is to put down at least 10% upfront. If you do. If you are still paying Mortgage Insurance Premiums (MIP) on a Federal Housing Administration (FHA) backed loan you may be paying more than you need to. The law also allows homeowners to request the termination of PMI once they gain 20% home equity, or 80% LTV of the original value. So at that time you can. FHA requires both upfront and annual mortgage insurance for all borrowers, regardless of the amount of down payment. MIP Rates for FHA Loans Over 15 Years. FHA loans do not pay PMI they pay MPI. The only way to eliminate paying it is to pay off the dmitrovchanin.ru often through refinancing the mortgage. Most lenders allow you to drop the PMI if you pay your loan down enough to where you owe less than 80% of value. Sometimes you might have to. You are required to pay mortgage insurance on FHA loans, but the mortgage insurance on these loans is called a mortgage insurance premium (MIP), not PMI. The.

An FHA MIP is an additional payment you make to secure the mortgage loan. Let's take a look at FHA MIP and see how much you can expect to pay over certain loan. If you have a Conventional loan, and your down payment was less than 20% of the purchase price, you have PMI. Once you reach 80% loan-to-value (LTV), you can. When does mortgage insurance go away? PMI is required until your loan has met certain conditions, like having 20% equity in your home based on it's original. Once your loan balance drops to $, (80% of the original value), you're free to do away with PMI, for good. Can PMI be removed if home value increases? Wait for MIP to expire. If you made a down payment of at least 10% on your home purchase, then your FHA MIP will expire after 11 years. Refinance into. Removing PMI · Your loan must be current. · In the last 12 months, you can't have been more than 30 days late on any payment. · In the last 24 months, you can't. Freddie Mac (Conventional): Private Mortgage Insurance (PMI) will drop off once the loan balance reaches 78% of the original purchase price. FHA: Mortgage. The FHA MIP is permanent and cannot automatically be dropped once the loan balance reaches certain levels. That is unless the borrowers take another option. How Do You Get Rid of Mortgage Insurance Premium? For any FHA loans taken out after June 3, , the only way to eliminate the mortgage insurance premium is. If you choose to refinance into a conventional loan from an FHA loan, you can get rid of FHA mortgage insurance premiums. This method and selling your home are. Wait for MIP to expire. If you made a down payment of at least 10% on your home purchase, then your FHA MIP will expire after 11 years. Refinance into. If you have an FHA loan, you'll pay MIP for either 11 years or the entire length of the loan, depending on the terms of the loan. What can I do to cancel my. Depending on the terms and conditions of your home loan, most FHA loans today will require MIP for either 11 years or the lifetime of the mortgage. FHA mortgage. Can You Get Rid Of Mortgage Insurance Premiums (MIP)? The removal of FHA MIP depends on when you close your loan and the percentage of the home's value you. Once you've built equity of 20% in your home, you can cancel your PMI and remove that expense from your monthly payment. If you're current on your mortgage. The good news is that you can request that your lender remove PMI once the principal balance of your loan reaches 80% of the original value of the property. To. The mortgage insurance never goes away on FHA loans (as of September 21, ). FHA rules can at times be a less restrictive compared to conventional loans. ▻, Does it cost me money to get MI removed? ; ▻, What if this is a rental property? ; ▻, Can I order my own appraisal? ; ▻, What is the difference between FHA. Conversely, with a down payment of 10% or more, MIP expires after 11 years. This differs from conventional loans, where Private Mortgage Insurance (PMI) can be. PMI is ordinarily required on loans for more than 80% loan-to-value. Most individuals who turn to FHA have little to put down and will therefore require PMI.

How Consultants Make Money

How to Generate a Passive Income as a Consultant · 1. Indirect Passive Income through Writing Blogs · 2. Create and Sell Online Courses · 3. Indirect Passive. The truth is Franchise Consultants essentially determine their salaries themselves. A Franchise Broker salary can vary from a supplemental income to an. They can bring you cool projects, negotiate rates + contracts, collect the money on time and help you navigate choppy waters (change in scope. Q: How much can I earn as a Tastefully Simple consultant? A: You can earn up to 40% on your personal sales as well as up to 7% leadership commission when you. But reputable consultants do not usually try to prolong engagements or enlarge their scope. money and time. And just as the client may participate in. At top consulting firms, entry-level management consultants may earn $, each year (bonuses and profit sharings included), while senior consultants may. 5 years experience and making 50K as a consultant is insane. Even for the UK where I know consulting graduate salaries can be around £35K for big 4. As you grow your consulting business into a million-dollar profit-generating machine, time becomes a premium. To save time and make your business more efficient. Pay scale. Independent consultants typically charge between $ and $ per hour, with an average rate of around $ per hour. Of course, rates vary. How to Generate a Passive Income as a Consultant · 1. Indirect Passive Income through Writing Blogs · 2. Create and Sell Online Courses · 3. Indirect Passive. The truth is Franchise Consultants essentially determine their salaries themselves. A Franchise Broker salary can vary from a supplemental income to an. They can bring you cool projects, negotiate rates + contracts, collect the money on time and help you navigate choppy waters (change in scope. Q: How much can I earn as a Tastefully Simple consultant? A: You can earn up to 40% on your personal sales as well as up to 7% leadership commission when you. But reputable consultants do not usually try to prolong engagements or enlarge their scope. money and time. And just as the client may participate in. At top consulting firms, entry-level management consultants may earn $, each year (bonuses and profit sharings included), while senior consultants may. 5 years experience and making 50K as a consultant is insane. Even for the UK where I know consulting graduate salaries can be around £35K for big 4. As you grow your consulting business into a million-dollar profit-generating machine, time becomes a premium. To save time and make your business more efficient. Pay scale. Independent consultants typically charge between $ and $ per hour, with an average rate of around $ per hour. Of course, rates vary.

Most mid-tier consulting firms pay a salary between $65,$70, for entry-level financial consultants. Senior financial consultants at these firms earn a. How much do business consultants charge? According to the Bureau of Labor Statistics, the median annual pay for a management consultant was $87,, or $ An energy consultant is a professional who works with individuals, businesses, and organizations to help them reduce their energy consumption and costs. How do education consultants make money? Educational consultants make most of their money the old-fashioned way, by charging school districts for their services. 6 Ways to Accept Payments as a Consultant · 1. Cash · 2. Checks · 3. PayPal · 4. Credit Cards · 5. Digital Wallets · 6. ACH Transfers. Most consultants only get paid when they sell a house to a buyer or for a seller. The house buying or selling process can take as little as a week, but in most. We're going to dive into ten new revenue streams in a consulting business that you can build more flexible and secure income. Want to know how to earn money as a consultant? It's easier than you think. There are many ways to earn money as a consultant: social media consulting. In that case, you can use it as a part-time online consultant and earn extra income even if you're doing a regular job. In most cases, online consulting can. make their fortune in consulting. They Have a realistic budget and know exactly how much money you need every month both in income and for expenses. 12 ways to make money as a consultant · Strategy consulting · Management consulting · Financial consulting · Marketing consulting · IT. Money is made on the margin: the difference between what clients pay your company, and what you pay your team. The more clients running through the business —. Management consultants are highly paid because the marketplace values them so. The questions is why this is so. · 1. Consulting clients are. The best freelance management consultants do make a very high income. So, it is % possible for you to do the same. However, if it was easy, everyone would do. How much is the demand for your service? If people don't want your service, no matter how great you are at it, you won't be able to make money. · How much are. This post walks you through the step by step process to sell your consultancy service online and the best place to sell the service to make a consistent income. Although on aggregate, consulting professionals tend to make less than their investment banker colleagues, consultants work significantly fewer hours which. consulting salaries stayed flat compared to There are exceptions to the rule, as you'll see in the report, but this is the first time in years we. But reputable consultants do not usually try to prolong engagements or enlarge their scope. money and time. And just as the client may participate in. The most common way for IT consulting companies to make money is by charging clients for their consulting services. This can be done on an hourly, daily, or.

30 Year Jumbo Mortgage Rates Ct

A year fixed jumbo loan is virtually identical, at %. A year fixed-rate loan is %, and a 5/1 adjustable rate loan is %. In Connecticut. Learn About FHA Loans. Year Jumbo Fixed. Rate%. /. APR%. Points. (). What are APR and points? Apply To Prequalify · Learn About Jumbo Loans. Year VA. Rate. Connecticut year fixed mortgage rates go down to %. The current Year Fixed Rate Jumbo. %. down %. %. down %. Year Fixed. Compare our current interest rates ; year fixed, %, % ; year fixed, %, % ; FHA loan, %, % ; VA loans, %, % ; Jumbo. Conventional Fixed Rate Jumbo Loans ; 30 Year, %, , %, $ ; 30 Year, %, , %, $ Loan 30 Year Fixed Mortgage · Points 0, Interest Rate %, APR1 % ; Loan 10/6m ARM · Points 0, Interest Rate %, APR1 %. Today's mortgage rates in Connecticut are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Check. National year fixed mortgage rates go down to %. The current average Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa. Today's year fixed mortgage rates. % Rate. % APR. A year fixed jumbo loan is virtually identical, at %. A year fixed-rate loan is %, and a 5/1 adjustable rate loan is %. In Connecticut. Learn About FHA Loans. Year Jumbo Fixed. Rate%. /. APR%. Points. (). What are APR and points? Apply To Prequalify · Learn About Jumbo Loans. Year VA. Rate. Connecticut year fixed mortgage rates go down to %. The current Year Fixed Rate Jumbo. %. down %. %. down %. Year Fixed. Compare our current interest rates ; year fixed, %, % ; year fixed, %, % ; FHA loan, %, % ; VA loans, %, % ; Jumbo. Conventional Fixed Rate Jumbo Loans ; 30 Year, %, , %, $ ; 30 Year, %, , %, $ Loan 30 Year Fixed Mortgage · Points 0, Interest Rate %, APR1 % ; Loan 10/6m ARM · Points 0, Interest Rate %, APR1 %. Today's mortgage rates in Connecticut are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Check. National year fixed mortgage rates go down to %. The current average Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa. Today's year fixed mortgage rates. % Rate. % APR.

Year Fixed Rate ; Rate: % ; APR: % ; Points ; Estimated Monthly Payment: $1, On Monday, September 16, , the average APR on a year fixed-rate mortgage fell 7 basis points to %. The average APR on a year fixed-rate mortgage. Year Fixed mortgage rates in Greenwich, Connecticut are at % with % point(s), Year Fixed mortgage rates in Greenwich, Connecticut are at. Compare current mortgage interest rates and see if you qualify for a% interest rate discount. Contact a Mortgage Loan Officer today! More details for Year Fixed-Rate Jumbo. Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Fixed-Rate Jumbo. Rates, terms, and fees. Jumbo Year Fixed-Rate: The average rate for Jumbo Year Fixed-Rate is now at %. Over the past week, we've seen a decrease of %, while the rates. We offer 15 year, 30 year, and Adjustable Rate Mortgages Options (5/1, 7/1, and 10/1). Higher Credit Scores are preferred to get up to 95% LTV financing. The mortgage rates in Connecticut are % for a year fixed mortgage and % for a year fixed mortgage. These rates are effective as of September Fixed Rate Jumbo Residential Mortgage · 30 Year Fixed Jumbo ($1,, Max) · 20 Year Fixed Jumbo ($1,, Max) · 15 Year Fixed Jumbo ($1,, Max). 30 Year Fixed CommunityWorks: The total repayment term for this fixed rate loan is 30 years or payments. Monthly principal and interest payments will be. year fixed · %. % ; year fixed · %. %. The average year fixed jumbo loan rate in Connecticut is % (Zillow, Jan. ). Today's Rates ; 15 Year Fixed Rate, %, %, %, $2, ; 30 Year Fixed FHA, %, %, %, $2, Track live mortgage rates ; Top 5 Originators in Connecticut. %. US Bank. %. Pennymac Home Loans ; Originations by Property Type. %. Single Family. Fixed Rate Mortgage Loans ; Year Fixed, As Low As, %, % ; Year Fixed, As Low As, %, %. For a $, loan amount with a year fully amortizing term at an initial % interest rate, the APR for this loan would be %. After the seven year. Connecticut Mortgage Rates ; Connecticut - 30 YR Fixed Jumbo, %, % ; Last updated on: 9/4/ PM. Fixed-Rate Jumbo Mortgages ; %, 0, %, $* ; %, 0, %, $**. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. The current mortgage rates stand at % for a year fixed mortgage and % for a year fixed mortgage as of September 15 pm EST.

Delta Blue Skymiles Card Review

Delta SkyMiles® Blue American Express Card · Earn 10, bonus miles after you spend $1, in purchases on your new Card in your first 6 months. · No Annual Fee. We like the Delta SkyMiles Blue American Express Card® because it offers elevated rewards on Delta purchases without charging an annual fee. This card is. Pros · Earn 2 miles per dollar spent on Delta and at restaurants and 1 mile per dollar spent on all other eligible purchases · 20% back, as a statement credit, on. An exclusive benefit for Delta SkyMiles Card Members, Pay with Miles gives you more flexibility to apply miles to the cost of your ticket so you can take. It's great for travel, especially if you prefer delta already. It doesn't give you all the high end benefits of a gold or reserve card but you also don't have. The Delta SkyMiles® Blue American Express Card has no annual fee (see rates and fees) and offers benefits such as a $0 foreign transaction fee (see rates and. The Delta SkyMiles Blue American Express Card is a no-annual-fee rewards card that's best for people with good credit or better who want to save extra at. Delta SkyMiles Blue American Express Card · Earn 2X Miles per dollar spent on Delta purchases, and 1X Mile on all other eligible purchases. · Pay with Miles: take. Delta SkyMiles credit cards offer Delta flyers quite a few perks, but they aren't the right choice for everyone. The earning rates are generally mediocre. Delta SkyMiles® Blue American Express Card · Earn 10, bonus miles after you spend $1, in purchases on your new Card in your first 6 months. · No Annual Fee. We like the Delta SkyMiles Blue American Express Card® because it offers elevated rewards on Delta purchases without charging an annual fee. This card is. Pros · Earn 2 miles per dollar spent on Delta and at restaurants and 1 mile per dollar spent on all other eligible purchases · 20% back, as a statement credit, on. An exclusive benefit for Delta SkyMiles Card Members, Pay with Miles gives you more flexibility to apply miles to the cost of your ticket so you can take. It's great for travel, especially if you prefer delta already. It doesn't give you all the high end benefits of a gold or reserve card but you also don't have. The Delta SkyMiles® Blue American Express Card has no annual fee (see rates and fees) and offers benefits such as a $0 foreign transaction fee (see rates and. The Delta SkyMiles Blue American Express Card is a no-annual-fee rewards card that's best for people with good credit or better who want to save extra at. Delta SkyMiles Blue American Express Card · Earn 2X Miles per dollar spent on Delta purchases, and 1X Mile on all other eligible purchases. · Pay with Miles: take. Delta SkyMiles credit cards offer Delta flyers quite a few perks, but they aren't the right choice for everyone. The earning rates are generally mediocre.

Card Members save 15% when booking Award Travel with miles on Delta flights when using dmitrovchanin.ru or the Fly Delta app. Anytime. With the Delta SkyMiles® Blue American Express Card, you can earn rewards when you book Delta flights and on everyday purchases without paying an annual fee. Delta SkyMiles® Blue American Express Card. Delta SkyMiles Blue American Express Card · Amex EveryDay® Preferred Credit Card from American Express. Amex. Delta SkyMiles Blue American Express card review dmitrovchanin.ru No, you should not open the delta blue card. The earning rates for that card are terrible. You would be better served by a 2% cash back card with no annual fee. Pros · Earn 2 miles per dollar spent on Delta and at restaurants and 1 mile per dollar spent on all other eligible purchases · 20% back, as a statement credit, on. Delta SkyMiles® Blue American Express Card Review: $0 Annual Fee · Delta has an impressive array of Amex-issued airline credit cards. · New card members earn. Credit Card Summary · Earn 10, bonus miles after you spend $1, in purchases on your new Card in your first 6 months. · No Annual Fee. · Earn 2X Miles per. The Delta SkyMiles Gold is great for Delta frequent flyers who also enjoy earning rewards on everyday purchases like groceries and dining. Note an unusual restriction: Welcome bonus not available if you've had another Delta consumer card in the past 90 days. FM Mini Review: This card offers an OK. The Delta SkyMiles Blue Card doesn't offer much in the way of perks or rewards. But it does let you earn miles with Delta Air Lines for no annual fee. This card is a good fit if you fly only occasionally and don't want to pay an annual fee. You get a few perks like 20% off inflight purchases, and a small. While it doesn't offer the same premium benefits as some of the higher-tier Delta cards, it provides a way to earn Delta SkyMiles on everyday purchases, making. The Delta SkyMiles® Blue American Express Card offers a bonus of Earn 10, bonus miles after you spend $1, in purchases on your new Card in your first 6. Budget-conscious Delta flyers. Not only will you rack up Delta miles at a nice clip thanks to this card's 2X rate on both eligible Delta purchases and at. The Delta SkyMiles Blue American Express Card is a solid starter card if you fly Delta Air Lines from time to time but aren't ready to commit to paying an. If you are a frequent Delta flyer, a Delta SkyMiles credit card can help you earn bonus miles toward a flight and provides valuable benefits. Overall, Delta SkyMiles card is strongly recommended based on community reviews that rate customer service and user experience. Does Delta SkyMiles Gold. Pros & Cons of Amex NB Delta SkyMiles® Blue Credit Card · Receive a 20% savings in the form of a statement credit when charging eligible Delta in-flight. The entry level no-annual fee Delta Amex card offers 2X Delta SkyMiles on Delta purchases as well as at restaurants worldwide.

1 2 3 4 5 6